Greenline Ventures ("Greenline") is an impact-driven investment management firm founded in 2004, committed to delivering innovative and flexible financial solutions to underserved businesses and communities often overlooked by traditional capital providers. In December 2016, Greenline advanced its mission by launching the $20 million Small Business Capital Fund I (SBCF), a transformative initiative designed to provide attractive loans with favorable, or even below-market, terms to small businesses operating in economically distressed census tracts across the United States.

The SBCF was crafted with a unique emphasis on flexibility and patience, accommodating businesses with tailored approaches to collateral, security requirements, amortization schedules, interest rates, fees, and more. Its primary goals include:

- Driving job creation and retention.

- Enhancing employee training and development programs.

- Improving worker benefits and supporting low-income employees.

- Championing minority- and women-owned enterprises.

- Promoting environmentally sustainable practices.

With loan amounts ranging from $250,000 to $2 million and terms spanning 12 months to 7 years, the SBCF caters to a wide array of business needs. Funds can be used for working capital, business expansion, equipment financing, or acquisitions. Since its inception, the SBCF has demonstrated impressive impact, distributing $11.35 million in loans by the end of 2016, fueling growth and resilience in communities that need it most.

IMPACT STORY: Discover Books

Discover Books, headquartered in Maryland, is a prominent wholesale re-seller of used books operating through various online retailers. The company is committed to protecting the environment by collecting, re-selling, and redistributing books. Discover’s mission extends beyond diverting books from landfills to include supporting library sustainability and addressing the global challenge of illiteracy.

Recently, the Socially Responsible Business Community Fund (SBCF) facilitated a loan from Greenline Ventures aimed at enhancing working capital. This funding has been instrumental in purchasing inventory, developing their website, and improving distribution centers located in Toledo, Ohio, and Hammond, Indiana.

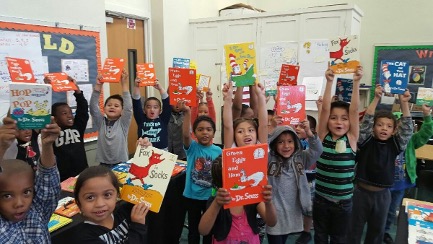

Children at the Cleveland Kids' book bank

The Praxis commitment

Praxis Mutual Funds supports organizations through investments in Calvert Impact, an impact-investing institution that helps people around the world through community development financing. It’s part of the Praxis commitment to place approximately 1% of each of its funds to benefit neighborhoods and individuals through community development investments.